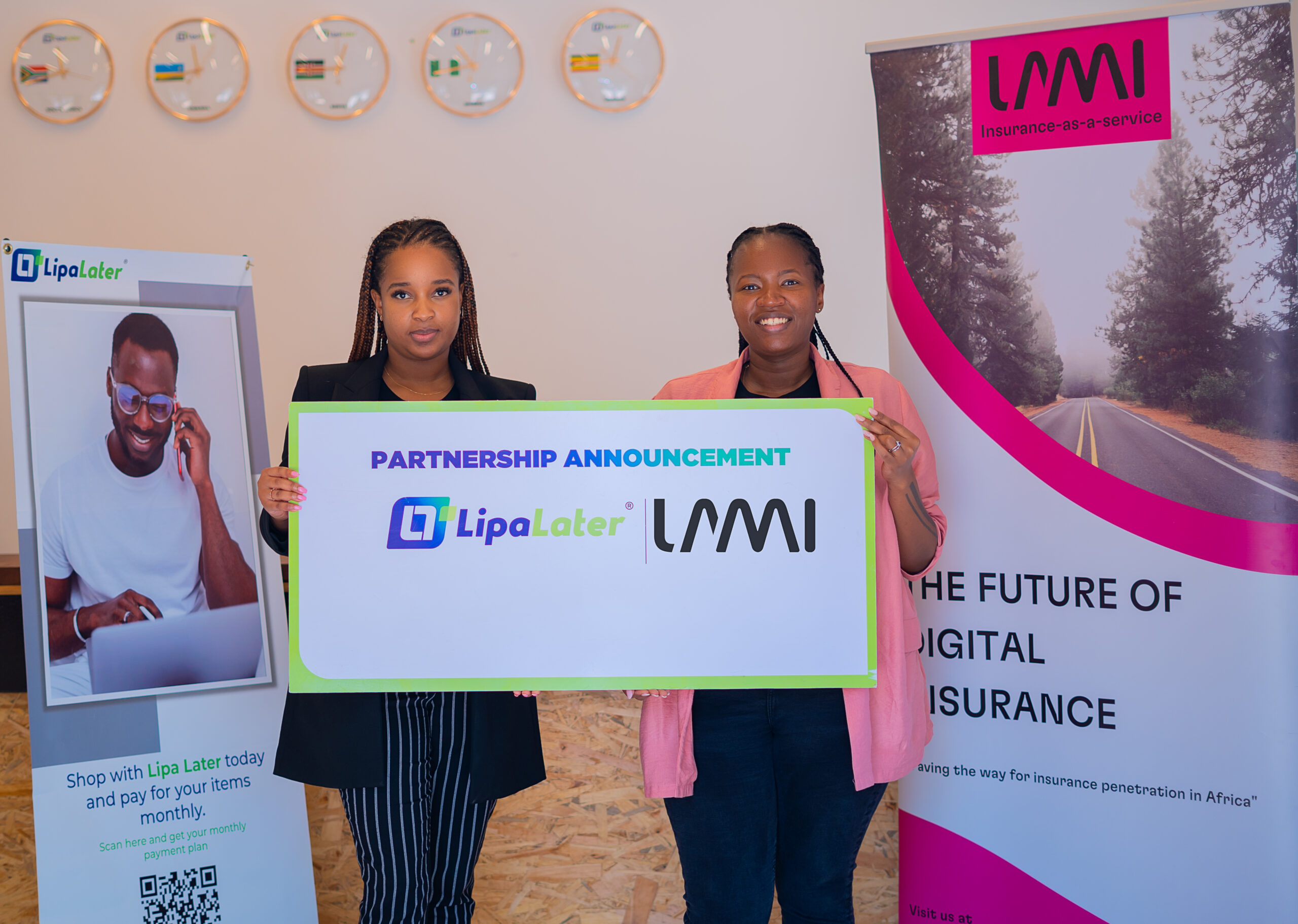

Lipa Later Announces Partnership with Lami Technologies

Lipa Later Group, a buy now, pay later (BNPL) company today announced a partnership with Lami Technologies, an insurance technology company, that will offer its consumers access to reliable and affordable insurance against all products purchased using the Lipa Later platform. Founded in 2017, Lipa Later is a trusted BNPL company operating in Kenya, Rwanda,…

Read Article →