TBD Expands in Africa, Adding Chipper Cash to Growing tbDEX Ecosystem

TBD, part of Block, which is focused on creating open and decentralized technologies to connect the financial world, today announces that leading African fintech Chipper Cash has integrated with the tbDEX protocol to power cross border payments and decentralized identity use cases for individuals and businesses on the African continent. “Across Africa, the challenges of…

Read Article →

Africa Tech Summit London Announces 15 Ventures for the 2024 Investment Showcase at London Stock Exchange on June 7th

Africa Tech Summit (ATS) London will celebrate the eighth edition at the London Stock Exchange on June 7th, 2024, and is thrilled to announce the 15 tech ventures that will join the ATS Investment Showcase 2024. The ATS London Investment Showcase provides ventures with the opportunity to present their businesses to leading African tech investors, corporates,…

Read Article →

Crypto Asset Class About to Take Off in South Africa as the Sector Becomes Licensed and regulated

Cryptocurrencies currently form a small portion of total investment capital in South Africa managed by fund managers, wealth managers and financial advisors. However, the recent approval by the Financial Sector Conduct Authority (FSCA) of several financial service provider licences could change this. This is one of the key issues explored in a new report by…

Read Article →

Tappi’s Collaboration with MTN Spurs Expansion in Cote d’Ivoire

Tappi, the end-to-end digital commerce SaaS solution tailored for Africa’s micro, small and medium-sized businesses (MSMEs), has today announced its expansion into Côte d’Ivoire. Building on its rapidly growing operations in Kenya and Nigeria, tappi’s latest country launch will feature an extension of its existing partnership with telecom giant, MTN, marking a significant step forward…

Read Article →

Top Use Cases of Blockchain Technology in Africa

Beyond all the hype, blockchain technology has multiple use cases that could bring positive changes to various sectors on the African continent. Some critics dismiss blockchain technology or reduce its application to only cryptocurrencies. However, the application of blockchain tech has evolved over the years with more attempts to create real-world impacts. In this article,…

Read Article →

Top 5 African Web3 Projects To Keep An Eye on in 2024

It’s almost 2024, and everyone is making projections into the new year. 2023 continued Africa’s study growth in the Web3 industry with more adoption and innovation. The list of African-owned or based Web3 projects continues to increase as various innovators find ways to use blockchain technology to fix some of the biggest issues on the…

Read Article →

M-KOPA Expands to Ghana, Unlocking $10m in Credit for Customers

M-KOPA, a leading African fintech platform, today announced the official launch of its flexible digital financing model in Ghana following a successful pilot phase. The strategic move to expand its operations makes Ghana the second West African country for the company, strengthening its Pan-African footprint to provide financial and digital inclusion for underbanked customers. The…

Read Article →

Turaco acquires MicroEnsure Ghana to deepen affordable insurance coverage across Africa

Turaco, Africa’s leading tech-enabled affordable insurance company, today announced the acquisition of MicroEnsure Ghana, a pioneering microinsurance company from MIC Global. Under the deal, MicroEnsure will rebrand as Turaco Ghana and retain the expertise of the existing team and leadership. The acquisition is part of Turaco’s long-term vision to provide simple and accessible insurance to…

Read Article →

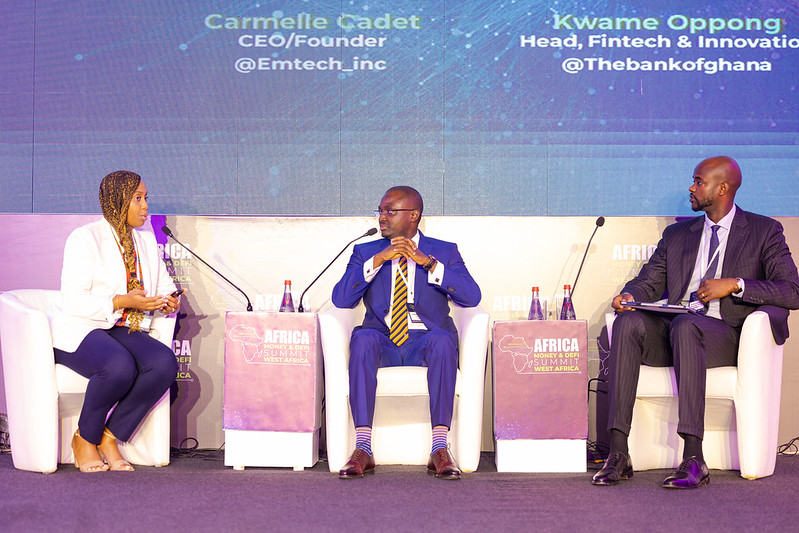

The State of Web3 in Ghana

Ghana is one of the bright spots in Africa’s cryptocurrency story. The West African country has often been touted as a state with immense potential and one of the candidates for major cryptocurrency adoption on the continent. In this article, the Africa Money & DeFi Summit looks at the state of the cryptocurrency industry in…

Read Article →

Ugandan Fintech startup, Emata has raises $2.4M

Emata – the agricultural finance solution for East African farmers – announces on their LinkedIn page its successful completion of a $2.4 million seed fund raise, comprising $800,000 in equity and $1.6 million in on-lending capital. The fundraise was backed by African Renaissance Partners – the VC firm investing in entrepreneurs in East Africa and…

Read Article →