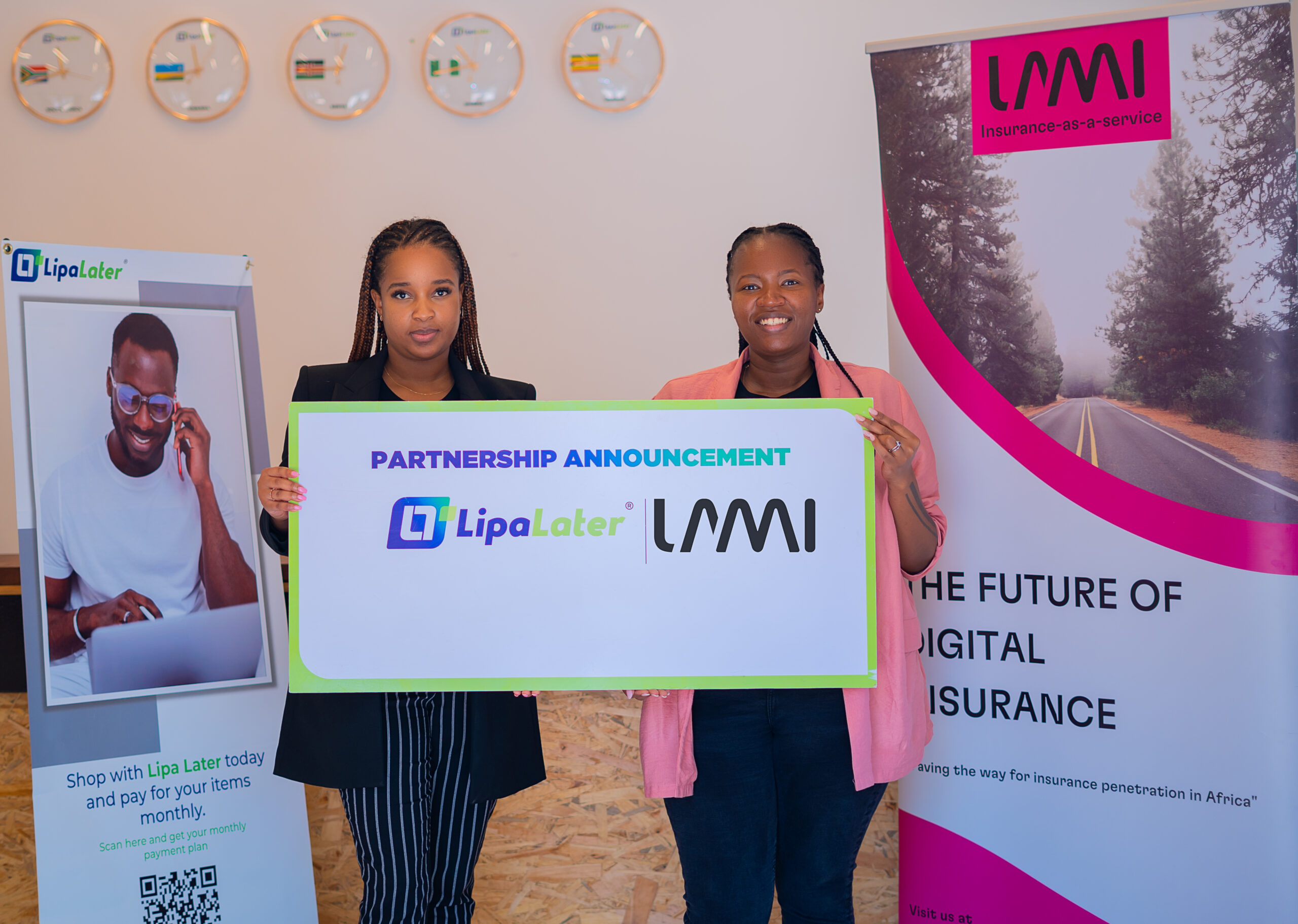

Lipa Later Group, a buy now, pay later (BNPL) company today announced a partnership with Lami Technologies, an insurance technology company, that will offer its consumers access to reliable and affordable insurance against all products purchased using the Lipa Later platform.

Founded in 2017, Lipa Later is a trusted BNPL company operating in Kenya, Rwanda, Uganda and Nigeria, with the sole purpose of providing financial solutions to consumers by increasing their purchasing power. Today, Lipa Later has become one of the most preferred alternative payment options for African consumers. Through this partnership, Lipa Later has embedded credit insurance to all products purchased through its platform. Consumers will be automatically protected during the installment period on costs related to any loss and damage caused by an accident.

Claudine Gakundi, Country Manager, Lipa Later said “Lipa Later has struck a partnership with Lami to facilitate the easy and seamless access to insurance for our consumers as we work on expanding our digital offering and growing our footprint in the BNPL space. Through this partnership Lipa Later customers will access insurance services affordably for the items they purchase through us. Creating a process where we move away from the traditional and expensive method of acquiring insurance to a fast, seamless and affordable method is a great opportunity in expanding access to insurance.”

Waithera Thingrui, Head of Business Growth, Lami Technologies said, “Lami Technologies has been spearheading the transition of affordable and reliable insurance in Africa. We aim to create inclusive prosperity in the region by developing coverage for people from different backgrounds. By partnering with Lipa Later to automatically insure products purchased through its platform, not only are we promoting inclusion in the insurance sector, but we are also enhancing the use of insurance to increase customer acquisition and retention. By doing this, we are also connecting businesses to a wider variety of insurance products that add value to the business while building customer trust and loyalty. We look forward to further collaboration with our partners to continue delivering relevant solutions that provide businesses and people with access to seamless and efficient insurance products.”

Lami Technologies was founded in 2018 to address the problem of low insurance uptake in Africa. Despite having 17% of the world’s population, Africa is among the world’s most underinsured places. Using innovation and technology, Lami is revolutionizing insurance for underwriters and businesses seeking to bridge the gap by making coverage affordable for all Africans.

Lami’s insurance technology is a powerful tool that offers businesses ease in identifying, pricing, and embedding insurance options with the opportunity to combine two or more products for effective coverage

With this partnership, all Lipa Later customers across its current markets, Kenya, Uganda, Rwanda, Tanzania, and Nigeria will have their purchased products covered with the all-risk insured