The African cryptocurrency market continues to evolve as more people adopt cryptocurrencies, new companies are started, and regulators make new pronouncements. Despite the evolution, more has stayed the same regarding the spread of adoption geographically. In this article, we explore the top cryptocurrency markets in Africa in 2023.

Since cryptocurrency adoption on the continent became a major narrative in mainstream crypto and traditional media, Africa has been tipped as a region that is expected to benefit immensely from innovation in the cryptocurrency space. In contrast, others argue that the cryptocurrency industry needs the continent to achieve extensive global penetration. These projections have primarily been made based on the nature of Africa’s population and the unique use cases of digital currencies in the region.

Africa’s population is the world’s youngest, with 70% under 30 in sub-Saharan Africa. This demographic creates fertile grounds for the adoption of new forms of technology, which is usually led by the youth, and an enabling environment for the composition of new tech capital cities filled with builders and innovators needed to move the Web3 ecosystem forward.

For use cases, crypto and its related innovations can potentially overhaul the entire financial system. From cross broader payments in the continent, which are currently broken to external transfers, also known as remittances, which play a big part in the GDP of multiple African countries, cryptocurrencies like Bitcoin and stablecoins like USD Coin (USDC), Tether (USDT) and Binance USD (BUSD) have replaced traditional banking and platforms like Western Union and MoneyGram.

What’s more, the unstable nature of African currencies and the high level of inflation make cryptocurrencies a better alternative for saving and storing wealth. Countries like Zimbabwe and Sudan are known for their inflation, but the situation on the continent post-pandemic has become so dire that more stable economies like Ghana and Ethiopia have recorded an inflation rate of 52.8% and 32.0% this year. The nature of the economies in these countries makes it difficult for citizens to save in their local currencies since they may lose a substantial amount of value. Other options like saving in global currencies like the U.S. dollar, are expensive through traditional means but can be done easily using stablecoins.

Finally, the growing cryptocurrency landscape is creating new opportunities for a region battling with high levels of unemployment. Young Africans are filling roles across various companies in the Web3 space, making it an area of interest for many. With all these factors and more, Africa is a major market for the cryptocurrency ecosystem. However, the level of interest and adoption varies among countries and sub-regions. We break that down in this piece:

Finding the Top African Cryptocurrency Markets

When looking at the top cryptocurrency markets in Africa, we can rely on several indicators to arrive at an educated guess of the countries with the most cryptocurrency adoption and interest.

Currently, most cryptocurrency activity on the continent happens through centralized channels like exchanges. These centralized platforms do not release data, breaking down the source of their volumes and traffic on the continent to the public, mostly for competitive reasons. This gap in crypto-specific data, coupled with the general challenging nature of collecting tech-related data on the continent, makes it difficult to reach an undebatable consensus on the top African cryptocurrency markets. However, some data aggregators have found ways to make an educated guess, which will influence the countries highlighted in this article.

For this article, we will rely on cryptocurrency ownership data from Singaporean cryptocurrency provider and aggregator Triple-A and various reports on interest in crypto and crypto-curious states from CoinGecko, a cryptocurrency data aggregator.

Data from Triple-A puts Nigeria at the top of African states with the most cryptocurrency ownership, followed by Kenya, South Africa, and Egypt.

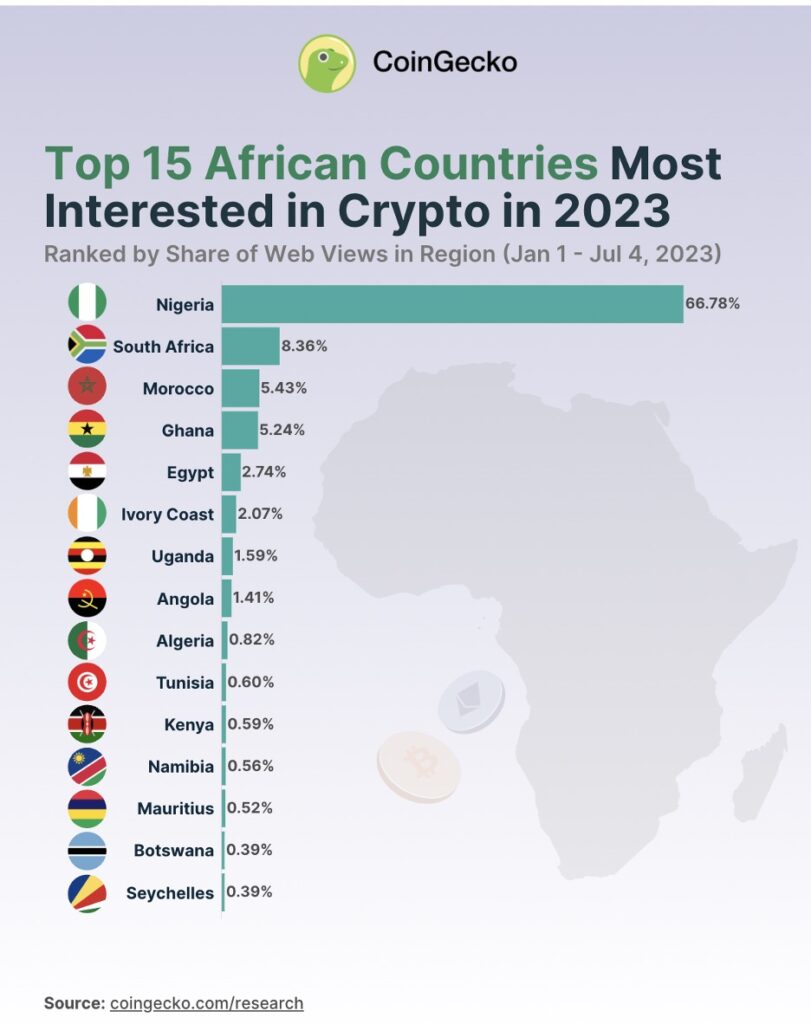

According to CoinGecko, the countries most interested in cryptocurrency in 2023 on the African continent include Nigeria, South Africa, Morocco, and Ghana.

Furthermore, in a more global report on countries that are the most curious about crypto, Nigeria placed first, while Kenya placed 15th.

Furthermore, in a more global report on countries that are the most curious about crypto, Nigeria placed first, while Kenya placed 15th.

Combining the data from various aggregators and the latest crypto-related headlines from the continent, this article will primarily focus on Nigeria, South Africa, Ghana, Kenya, and Morocco as the top cryptocurrency markets in Africa.

Nigeria

The “Giant of Africa” is not only dominating pop culture as it leads the global takeover by Afrobeats and related genres but is also leading the pack in the cryptocurrency space. Nigeria remains the top crypto market in Africa based on all indicators.

According to the CoinGecko report on the level of crypto interest in Africa, Nigeria recorded the highest interest, with 66.8% of crypto interest in the continent year to date (YTD), more than seven times the second country on the list.

Beyond interest, Nigeria has also been praised for its high volumes across peer-to-peer platforms like Paxful and LocalBitcoins (when the platform was operational) and centralized platforms like Binance.

Regulators in Nigeria remain cautious about cryptocurrency usage in the country. After asking regulated financial entities to seize any partnership with crypto firms and close accounts related to cryptocurrency transactions, regulators have made interesting moves that further confuse stakeholders.

For instance, a new law approved in May introduced a 10% tax on gains from the disposal of digital assets, including cryptocurrencies. The law’s implementation has hit a roadblock since it contradicts existing regulations that do not recognize the use of crypto in Nigeria.

Despite the government’s opposition to cryptocurrencies, the West African country has seen the deployment of blockchain technology by state institutions in essential areas. The Nigeria Federal Executive Council approvedthe national blockchain policy in May this year to help develop a framework for blockchain adoption. The Central Bank of Nigeria launched the e-naira in October 2021 and has dedicated resources to increasing its adoption, from hackathons to the addition of near-field communication (NFC) technology to its CBDC mobile app.

Furthermore, the National Information Technology Development Agency (NITDA) announced the use of blockchain technology to generate and validate National Youth Service Corps (NYSC) certificates in Nigeria. The announcement was made by the director general of NITDA, Kashifu Inuwa Abdullahi, at the Stakeholders’ Policy Dialogue on the National Blockchain Policy.

As more investments continue to pour in and Nigerian-led cryptocurrency projects begin to take center stage. The West African state is positioned to continue its lead on the continent and become a bigger player globally.

South Africa

South Africa is another cryptocurrency bright spot on the African continent. The country has consistently appeared in the top five of lists about African countries with the most crypto adoption, interest, or volume. Unlike most countries with high cryptocurrency adoption and interest on the continent, South Africa has enjoyed much more positive and welcoming regulations.

In October 2022, the Financial Sector Conduct Authority (FSCA), South Africa’s financial regulator, stated that crypto is a financial product subject to financial services law. This kickstarted proper regulations for digital assets in South Africa. The latest on regulations in the country is a report by Bloomberg that indicates crypto exchanges will be required to obtain licenses by the end of the year.

Major adoption milestones in the last 12 months include the acceptance of Bitcoin in about 1,628 stores by South African grocery retailer Pick n Pay. That level of adoption currently stands as the largest adoption by a single brick-and-mortar (physical) store in terms of scope on the continent and one of the most extensive in the world.

As regulations take shape, South Africa is set to attract more companies looking for a stable environment to ground their African operations.

Ghana

Ghana continues to relish in its potential while experts await its bloom. The West African state continues to show positive indicators when measuring interest and volumes but has yet to quite reach the levels of other countries in this list. In a report by Chainalysis, the blockchain analytics platform mentioned that Ghana has potential for crypto adoption similar to Nigeria and Kenya.

One thing it has in common with most countries on this list is negative regulatory sentiments. The Bank of Ghana has maintained that cryptocurrency is unregulated and that the general public is discouraged from engaging in crypto-related activities. Amid whispers of a cryptocurrency sandbox by regulators, the Central Bank of Ghana has shown keen interest in the development of a central bank digital currency (CBDC) and has become one of the leaders in the field on the continent.

During the Africa Money & DeFi Summit in Accra last year, Kwame Oppong, an executive at Ghana’s central bank, told Cointelegraph that CBDCs will give citizens a “decent form of payment.” He said:

“I think in terms of CBDC, our goal is to be able to finish testing it. We’ve seen the results. We’re going to look at the study each and every time in the future. But our real reason for doing it is more financial inclusion.”

Powered by a growing wave of educational initiatives like ETHAccra and developer-oriented activities by firms like Aya, Ghana is looking to build on its potential as a major cryptocurrency market in Africa.

Kenya

Kenya is the biggest cryptocurrency market in East Africa. The country has consistently recorded the highest volume and interest in the sub-region and continues to be one of the top cryptocurrency markets in Africa.

Until recently, no law officially recognized cryptocurrencies in Kenya. However, the Digital Asset Tax (DAT), introduced and passed as part of the Finance Bill 2023, imposes a 3% tax on trading digital assets. The taxation of cryptocurrency activities has been met with severe opposition by the Kenyan cryptocurrency community. The Blockchain Association of Kenya (BAK) has filed a petition before the High Court of Kenya, challenging the legality and constitutionality of the Digital Asset Tax (DAT).

The biggest cryptocurrency headline from Kenya in recent months has been the popularity of Worldcoin and its subsequent suspension. Pictures of people joining queues to be onboarded by Worldcoin in Kenya filled social media platforms like X (formerly known as Twitter) after the project launched. A few weeks later, Kenya’s minister of internal security announced that the human identity project had been suspended due to potential risks.

Despite the awkward nature of the Worldcoin saga in Kenya, it shows significant potential for cryptocurrency and blockchain adoption under the right circumstances, accompanied by good incentives.

Morocco

Morocco has become the leader in cryptocurrency activity in Northern Africa despite strict regulations that have led to harsh punishments, including jail time for some unfortunate crypto users.

Triple-A, a Singaporean cryptocurrency provider and aggregator, estimates that 0.9 million Moroccans own cryptocurrency, representing about 2.4% of the total population. According to the same report, Morocco is the top country in North Africa and part of the top 50 globally in terms of crypto ownership by population.

Bitcoin peer-to-peer (P2P) data platform Useful Tulips also confirms Morocco’s lead in trading volumes in Nothern Africa, as the Kingdom of the West records the most volume of Bitcoin traded on P2P platforms.

Another major development in Morocco is the construction of a 36-megawatt Bitcoin mining farm by a U.S. private equity firm. The firm intends to leverage local laws by selling at least 20 percent of its electricity output to the Moroccan government. The project is expected to take advantage of the capacity to build one of Africa’s largest wind farms to mine Bitcoin.

Despite the keen interest in cryptocurrencies, Moroccan authorities have banned the trading and use of cryptocurrency in the country. The Foreign Exchange Office has explained that it is not ready to support a hidden currency not backed by governmental institutions. In 2021, Thomas Clausi, a 21-year-old French citizen who purchased a luxury car with Bitcoin, faced 18 months in prison and a $3.7 million fine. Attempts to appeal the sentence were futile as the Casablanca Court of Appeal upheld the conviction of the 21-year-old

Regulations in Morocco may be taking a more positive turn in the coming months. At the beginning of the year, the Moroccan central bank indicated that a crypto bill would legally define crypto and its usage in the country. Not much development has been seen on the matter since the mention of the said bill.

Others

Some other countries on the African continent are bright spots for cryptocurrency adoption and interest despite not making the top five. Seychelles may not appear in various reports about cryptocurrency adoption in Africa, but the island and business-friendly tax haven plays a significant role in the global crypto arena. Six out of the top 30 centralized cryptocurrency exchanges are incorporated in the country. Notable cryptocurrency exchanges incorporated in Seychelles include OKX, KuCoin, and MEXC Global.

Other countries like Egypt, Ivory Coast, and Uganda are showing signs of growing cryptocurrency adoption and interest, which could develop into something substantial in the coming years

How can brands and crypto enthusiasts amplify adoption in the top African cryptocurrency markets and potential bright spots? Find out at the Africa Money & DeFi Summit 2023 in Accra, Ghana.